mississippi vehicle sales tax calculator

Opry Mills Breakfast Restaurants. Mississippi salary tax calculator for the tax year 202122.

What S The Car Sales Tax In Each State Find The Best Car Price

Select the model year.

. Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. You can find these fees further down on the page. Mississippi DMV registration fees are about.

Car purchases are usually one of the biggest sales in Mississippi which means they can lead to big sales tax payers. Delivery Spanish Fork Restaurants. Tag amount plus Casual Sales Tax.

Calculadora Canon P23-dh V 2 Color Mini-desktop Printing Calculator Calculadora Calculator Desktop Calculator Prints 775 for vehicle over 50000. How to calculate sales taxes by 2022 by voice. March 1 2022.

Enter the valuation from your last tag receipt. 775 for vehicle over 50000. If you are unsure call any local car dealership and ask for the tax rate.

By using the Mississippi Sales Tax Calculator. Mississippi has a 7 statewide sales tax rate but also has 142 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0065 on. - Select this method if you have your last tag receipt.

Only on vehicles less than 10 years old and purchased from an individual. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Mississippi auto sales tax calculator.

Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Restaurants In Matthews Nc That Deliver. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Motor Vehicle Ad Valorem Taxes. Enter the purchase price. 635 for vehicle 50k or less.

635 for vehicle 50k or less. Calculating Sales Tax Summary. 2000 x 5 100.

Car tax as listed. Income Tax Rate Indonesia. Our sales tax.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Mississippi Vehicle Sales Tax Calculator. Before-tax price sale tax rate and final or after-tax price.

Motor vehicle titling and registration. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city county.

Tag Cost with 5 in Penalities. During the year to deduct sales tax instead of income tax if. Home Motor Vehicle Sales Tax Calculator.

You can do this on your own or use an online tax calculator. Once you have the tax rate multiply it with the vehicles purchase price. Subtract these values if any from the sale.

Tag amount with penalities added with no Casual Sales Tax. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Find your state below to determine the total cost of your new car including the.

Usually the seller takes the sales. Interactive Tax Map Unlimited Use. Our free online Mississippi sales tax calculator calculates exact sales tax by state county city or ZIP code.

The exact taxable value will vary for your vehicle based on the MSRP and the available state tax incentives. For additional information click on the links below. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Soldier For Life Fort Campbell. Mississippi Vehicle Tax Calculator. In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle.

Enter the Manufacturers Suggested Retail Price. Without Penalties Credit From Another Tag or Casual Sales Tax Casual Sales Tax. Registration fees are 1275 for renewals and 1400 for first time registrations.

You pay tax on the sale price of the unit less any trade-in or rebate. Total price is the final amount paid including sales tax. For more information on renting or leasing vehicles see.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Mississippi collects a 3 to 5 state sales tax. - Select this method for used vehicles where the Purchase Price is known.

Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200. Registration fees are 1275 for renewals and 1400 for first time registrations. There is no county sale tax for mississippi state mississippithere is no city sale tax for mississippi state.

425 Motor Vehicle Document Fee. Essex Ct Pizza Restaurants. Tag Cost with 15 in Penalities.

425 commission per paper transaction per vehicle. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees.

Dealership employees are more in tune to tax rates than most government officials. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. Keep in mind that the original price.

How to calculate sales taxes in. Ad Lookup Sales Tax Rates For Free. Tag Cost with 10 in Penalities.

For vehicles that are being rented or leased see see taxation of leases and rentals.

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax On Cars And Vehicles In Mississippi

Understanding Mississippi Property Taxes Mississippi State University Extension Service

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Mississippi Sales Tax Small Business Guide Truic

Tax Rates Exemptions Deductions Dor

Dmv Fees By State Usa Manual Car Registration Calculator

How To Calculate Sales Tax In Excel

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

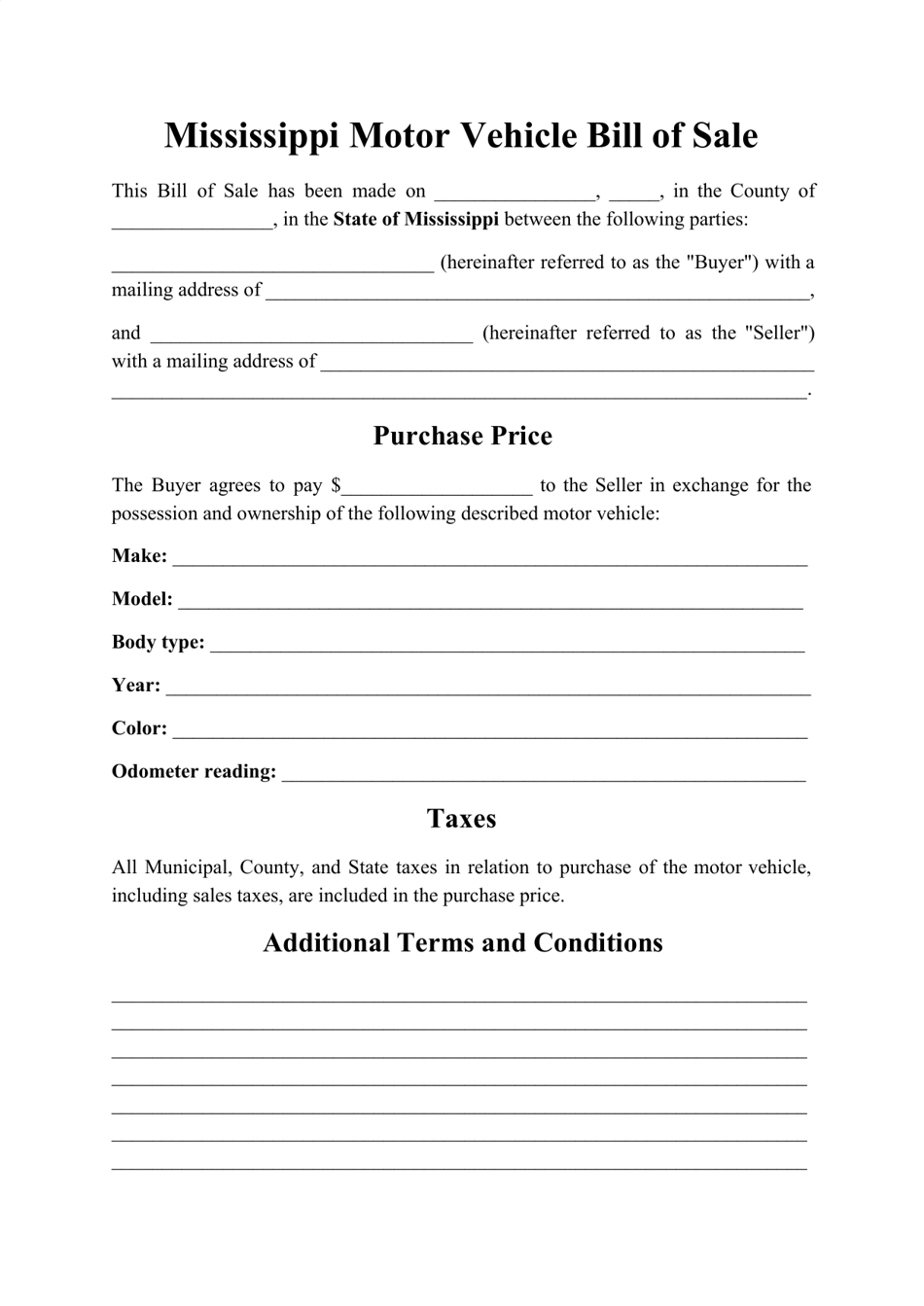

Mississippi Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Car Sales Tax In Mississippi Getjerry Com

Mississippi Income Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

Connecticut Sales Tax Calculator Reverse Sales Dremployee